HomeOwner Agreements are structured as Option Contracts. This is the legal framework that allows us to give you long-term cash without monthly payments or interest. An option contract gives the buyer of the option the right to buy a specific asset at a later date at an agreed upon price. In short, Unison makes its Initial Payment to you in exchange for the option to buy a portion of your property in the future at a price that we agree on up front. But we have no desire to co-own your home. We can exercise our option only when our Agreement ends, and solely for the purpose of terminating the relationship and settling the obligation you have to Unison.

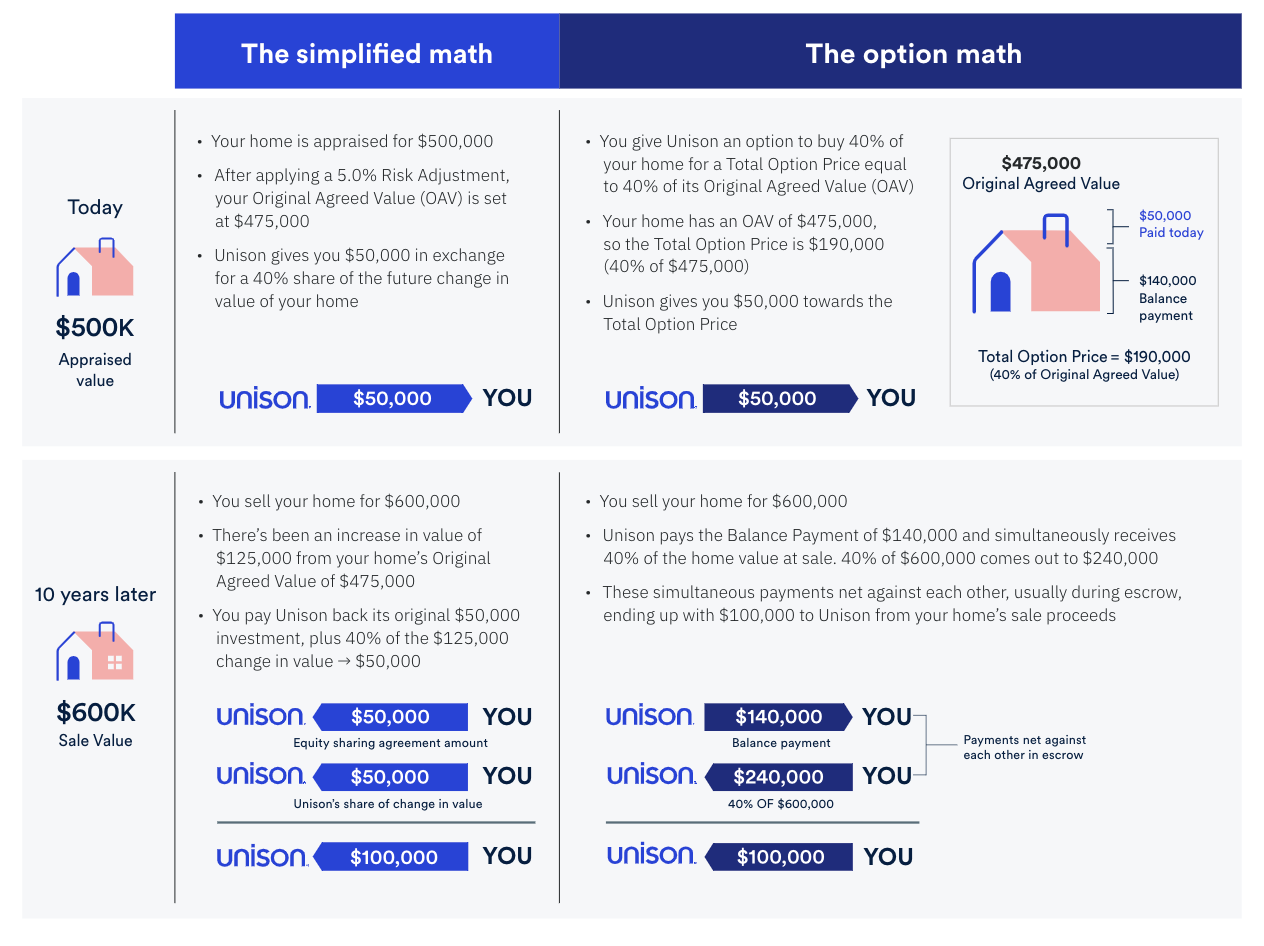

Most of our educational materials use a simplified method to calculate Unison's payment when the Agreement ends. The option math works a little differently, but note that both calculation methods will always produce the same results. The example below illustrates this by comparing the simplified math to the option math.

Breakdown: Option Contract Scenario

At the beginning, Unison purchases an option to buy 40% of your home, which is worth $400,000, in two payments – one now, at $40,000, and one at future exercise, at $116,000. In the future, you sell your home for $490,000.

A title company will typically handle the finances for you, and will process several transactions simultaneously. In one of those transactions, Unison will exercise its option to purchase 40% of your home by paying the title company the second installment payment of $116,000. In another transaction, they will pay us our “share” in the sale of the home (40% of $490,000, equaling $196,000). But, since the transactions are simultaneous, they simply deduct one from the other: $196,000 – $116,000 = where we arrive at one payment to Unison of $80,000.

Note: The net return to Unison at the end of our agreement together is the same as the simplified, non-option math that shows accessing $40,000 from a home that increases in value from $390,000 to $490,000 will result in a net payment to Unison of $80,000 at sale.

So, the option math is more complicated, but the title company will manage that part. If you focus on the simple math from before, it will do the same job of keeping you on the right page.

Remember: You decide when the option contract ends. Unison cannot exercise our option until you make the decision to buy us out early, sell your home, reach the 30 year max term, or if you materially default on your mortgage. Read more about the different ways that our agreement ends later in the section Ending Your Unison HomeOwner Agreement.

Some Situations

The Option Contract means we have incentives to work with you through difficult circumstances (foreclosure, damage to the house, etc). Because we want your home to be worth as much as possible (just like you do), we can wait until circumstances have improved and you’re ready to sell. This makes the relationship set up by the option contract different, but in a good way.

Option exercise and Orderly Sale

Unison can choose to offer the homeowner a remedy of Orderly Sale in lieu of the foreclosure proceeding, by offering to cure the circumstance of default. The homeowner will have the right to accept or reject this offer. Should the homeowner accept the offer, Unison will make one or more Protective Advances to cure the homeowner’s default, and the homeowner will give Unison the right to market and sell the property in an orderly sale in the customary manner in its local market. Option Exercise and Orderly Sale is designed to prevent the home from becoming a “distressed” property and going to foreclosure, which preserves the market value of the property, and the value of both the homeowner’s and Unison’s equity interest in the property. Following the Orderly Sale, the homeowner and Unison will share the proceeds according to the provisions of the Unison HomeOwner Agreement.

Deferred Maintenance Adjustments

We trust you’ll take care of your home – but in the event you don’t?

Prior to signing an Agreement with Unison, we typically require a home inspection. While many inspections don’t reveal anything new (maybe a lost sock?), they sometimes uncover defects or conditions that can affect the property value if not addressed. For example, an inspection might reveal significant rot in the framing under the home’s main living area. An issue like this may worsen over time, thus negatively impacting the property’s future value and desirability.

If a significant issue(s) is found during the inspection, Unison may make note of it in a Deferred Maintenance Addendum. Ideally, the homeowner will arrange for the necessary repairs to be made. However, if the homeowner doesn’t, Unison reserves the right to treat the issue as a Deferred Maintenance Adjustment scenario in the future. Note: You will always be notified if this Addendum is part of your original Agreement.

Special Termination

At any time during your agreement, you can choose to terminate your relationship with Unison. An appraisal will take place, and you'll be responsible for the initial amount given to you by Unison, as well as the Investor Percentage (our share of the change in value) of any increase in value as determined by that appraisal. Also, Unison does not share in any downside in the case of a Special Termination.

Our consumer contract set

To do a deep dive into the HomeOwner Agreement itself, we recommend you give it a read. Your Program Specialist will be happy to provide you with a copy of any of the below prior to closing your deal. Here is a summary of each contract that comprises the HomeOwner Agreement:

Option Agreement

This contains the basic financial terms of the Unison HomeOwner Agreement and describes in further detail how this particular Option Contract works.

Covenant Agreement

This outlines your rights and responsibilities under the Unison HomeOwner Agreement, as well as the various ways the Agreement can come to an end. It also documents the legal protections available to both you and Unison.

Security Instrument

This document creates a secured lien on the home during the term with Unison and says the lien will be recorded in the jurisdiction where the property is located. It also discusses the fact that the Security Instrument is typically subordinated to any existing mortgage on your property.

Memorandum

This document highlights specific features of the Agreement for public notice and is also recorded on the property.

Fees

There is a one-time transaction fee equaling 3.0% of the equity sharing agreement due to Unison at closing, which is deducted from the proceeds you receive. You are also responsible for third-party costs such as appraisal and settlement costs (includes title, state taxes, and recording fees). The third-party costs will be disclosed to you prior to closing, and deducted from your proceeds.

The content on this page provides general consumer information. It is not legal or financial advice. Unison has provided these links for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of the other websites.